How the Section 179 tax deduction can save your machine shop tons

In the wake of the recession, many ordinances were created and expanded to help small businesses, a lot of which still exist today. Ironically though, the same small businesses these tax breaks and deductibles were created to help may not have the time to decipher the inscrutable tangle of tax codes that these benefits lie buried in. Today we’re going to make quick sense of the deceptively simple section 179 tax deductible, and how it can save you loads on all of your machinery purchases. To see potential price savings on particular machines, go directly to our site and search for what you need.

Section 179 and Machine Tools

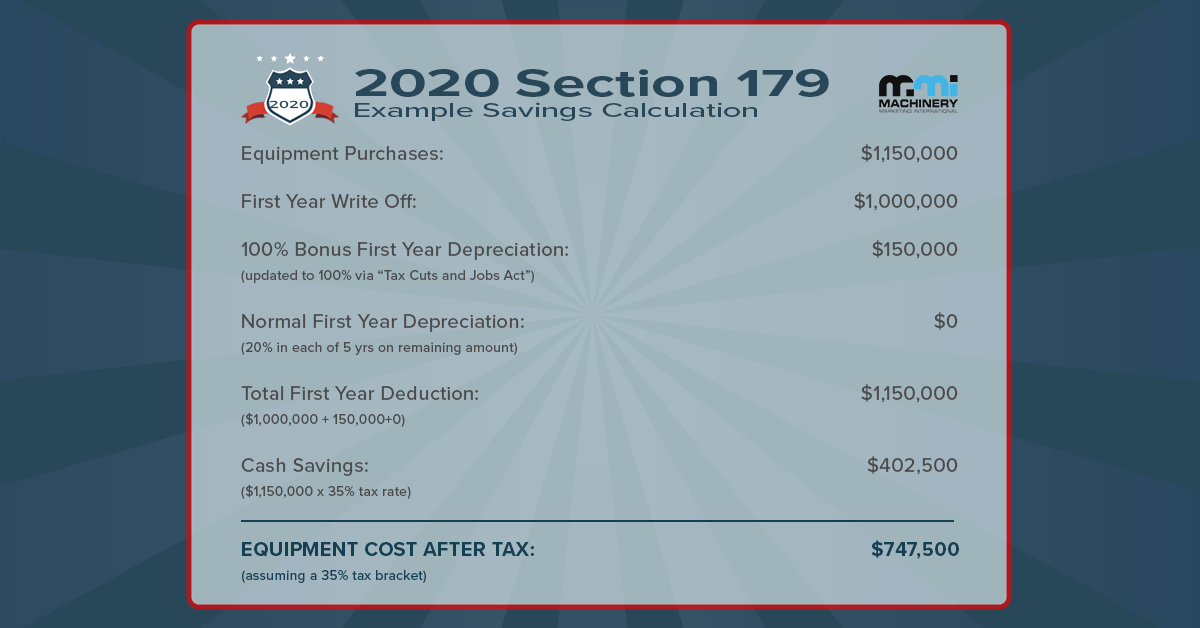

There’s a good chance you’ve already heard about the section 179 deduction—after all, it’s practically tailor made for machine shops. If not though, it’s a tax code created to encourage small businesses to purchase and lease new equipment. It allows businesses to deduct the full price of all qualifying pieces of equipment and/or software bought or financed during the tax year, up to $1,040,000 in 2020. Given the volume of expensive equipment machine shops make constant use of, it should be no mystery how that can benefit you. Here's an easy to use calculator that can help you estimate your tax savings.

First off, keen readers will have no doubt noticed that I mention “qualifying” equipment. Don’t worry, that’s nothing to worry about for you; all industrial machinery, even pre-owned, is valid for deduction. It also includes office equipment and furniture, software, and even certain modifications to your shop, like roofing and security systems. The restrictions in place mostly affect the purchasing of vehicles, to discourage a CEO from using the code to write off his new sports car. Even then, certain vehicles like forklifts and cargo vans may still be covered under the deduction.

If you’re worried about time, as a busy machinist often is, the section 179 deduction is actually relatively easy to take advantage of, especially given that you’ll likely be writing off a lot of money for relatively few purchases. Speaking of purchasing though, by now you’re probably wondering…

Yes and yes!

In fact, financed or leased equipment is often the perfect candidate for a 179 write-off. When deducting a financed machine, you’re still able to deduct the full price of the machine. Depending on your plan, it’s actually entirely possible to end the year with more in your bank account than if you’d never bought the machine in the first place.

The 179 Deduction is Not Automatic

All right, let’s get down to brass tacks—or should I say, brass tax. 179 rewards the diligent: the deduction is not taken out automatically, and if you wish to make use of it, you’ll have to elect to take it. Luckily, that’s pretty easy to do.

If you decide to take the 179 deduction(and why wouldn’t you?), you just have to elect to take it when filing your taxes at the end of the year. Whether you leased the equipment or not, the process is the same. All you have to do is fill out part one of IRS form 4562 and attach it to your tax return, just as you would any other additional form. You’ll be able to find the form here on the IRS website come tax season, as well instructions on how to fill it out if you get stuck.

If you still don’t feel comfortable filling out though (or you’re allergic paperwork), you can hand the form off for your tax preparer to take care of.

In addition, you can even apply the 179 deduction retroactively to purchases made in past years. That’s right, if you forgot to elect to take the 179 deduction in any year after 2007, you can still go back and amend that if you still have record of the purchases.

So that’s the section 179 deduction. The value of the deduction has fluctuated over the years, but right now it’s at the highest it’s ever been, having recently doubled since last year! However, while it was recently made a permanent staple of the tax code, there’s no guarantee the laws won’t shift again, and it’s impossible to tell if this rise will last, so be sure to take advantage of it while you can.

ABOUT MACHINERY MARKETING INTERNATIONAL:

MMI is a global leader in used machinery transactions. Buyers can easily browse through hundreds of quality used CNC machines online or talk to an experienced account manager to find the perfect match for their needs. Sellers can get value quick through direct purchase, trade-in, or leverage MMI’s vast marketing network to get the top value on their equipment—and whatever the choice, make use of MMI’s worldwide storage, rigging, logistics, and quick appraisal services. Buying or selling, one machine or one hundred,

MMI is the smart way to BUY MACHINERY and SELL MACHINERY.